UVXY, the highly popular ETF tracking VIX futures, is a complex financial product. Its issuer warns for good reasons that UVXY has been “designed for knowledgeable investors”.

The Important Basics

- UVXY is not a stock but an ETF (= exchange traded fund) issued by ProShares.

- UVXY tracks the daily returns of the one-month blend of first and second month VIX futures – with leverage factor 1.5x.

- UVXY does not track daily returns of spot VIX.

- A buy-and-hold strategy leads to significant losses.

Continue reading to learn how UVXY works and how successful trading strategies look like.

What does UVXY track?

As mentioned above, UVXY does not track the spot VIX but a blend of VIX futures.

Let’s first understand what the VIX is and how it works.

- The CBOE Volatility Index (VIX) measures the implied volatility of S&P 500 index options.

- In simple words, implied volatility is a concept to measure the willingness of option traders to pay lower or higher prices for options.

- When option traders expect large moves in the S&P 500 over the course of the life of an option, they pay more for an option. Higher option prices (with all other things such as time to expiration, strike, etc. being the same) mean that implied volatility is high.

- Expecting small moves in the S&P 500 between now and expiration, option traders pay less for an option. This means that implied volatility is low.

Now, let’s move on and discuss what various VIX levels mean.

- A low VIX (for example, 15) means that option traders expect the S&P 500 to move not more than 15% down or up over the next 12 months. The probability assigned to this expectation is 68.3%.

- A high VIX at 40 means that options traders expect the S&P 500 to move not more than 40% down or up over the next year.

- VIX is an annualized volatility measure. To convert annual values into daily ones, divide the annual value by the square root of trading days. For example, VIX at 32 means that daily S&P 500 returns of plus/minus 2% are expected (32 / sqrt(252) = 2).

Unfortunately, the VIX is not tradeable. While the VIX is widely reported, one cannot buy or sell the VIX.

In response to market participants’ desire to trade in VIX, the CBOE introduced VIX futures.

- VIX futures were introduced in March 2004.

- A VIX future is a future contract on the value of the VIX on a specific day.

- Monthly VIX futures expire in the morning of the Wednesday 30 days before the next S&P 500 monthly options expiration.

- Consequently, the last trading day for a VIX future contract is Tuesday just before expiration.

The underlying of UVXY (i.e., the index that UVXY tracks) is the one-month blend of first and second month VIX futures.

- In simple words, UVXY tracks the daily returns of a daily-changing blend of first and second month VIX futures.

- Every day around the market close, UVXY sells some first-month contracts and buys some second-month contracts to maintain the weighted length to expiration at exactly one month.

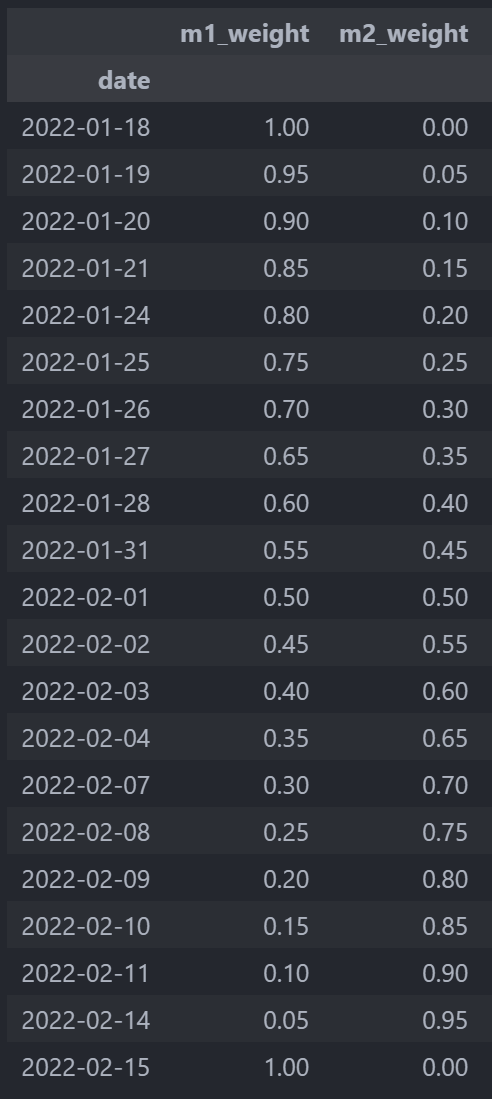

- Below table shows a volatility ETF that has 100% of its assets in first month futures on January 18, and then every day reduces that position by 5% to buy second month futures.

- When the first month contract expires, the second month contract becomes the “new” first month contract and holds 100% of the volatility ETF’s assets. And the cycle can begin anew.

- The index tracked by UVXY is known as S&P Dow Jones “S&P 500 VIX Short-Term Futures Index”. For more details how this index works and is updated, please study this methodology PDF.

The daily returns of the one-month VIX futures usually differ in terms of magnitude from those of spot VIX – and not infrequently even the direction of daily returns can be different.

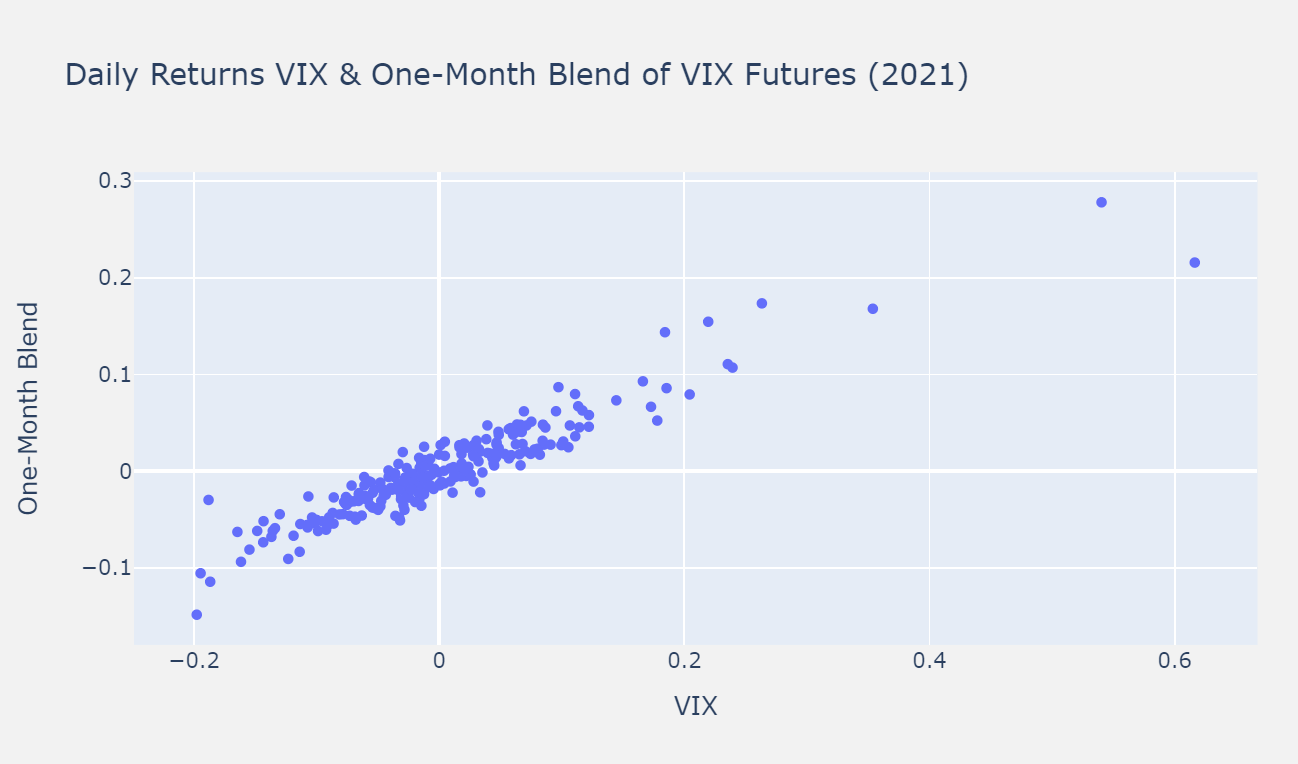

- Below chart shows daily moves of both VIX and the one-month blend of first and second month VIX futures.

- In the top-right corner, there are two trading days when VIX went up 54% and 62%, respectively, but the one-month blend jumped only 22% and 28%, respectively.

- Similar situation in the bottom-left corner: The VIX lost around 20% four times, but the one-month blend declined by 5% – 15% only.

- There were also quite a few days when VIX went up slightly but the one-month blend went down.

Not using the untradeable spot VIX as underlying but the one-month blend of VIX futures leads to significant UVXY net-asset-value reductions over time.

- More than 80% of trading days, VIX futures are in contango.

- Contango describes a situation when the futures price is above the spot price.

- Assuming the spot VIX does not change much, the prices of the first and second month VIX futures contracts move every day a little closer towards the spot price.

- This daily downward move of futures prices results in a negative return of the underlying (even though spot VIX is more or less unchanged). As a result, UVXY loses net-asset-value.

- Even seasoned volatility ETF traders often misunderstand contango and its impact on a VIX futures ETF. Here is an article with detailed additional explanations and numerical examples: How contango erodes the value of long volatility ETFs and ETNs

Contango is not the only source of UVXY decay. The leverage factor plays an important role too, and its net-asset-value destructive impact is known as leverage decay or beta slippage.

Key Take-Aways how UVXY works

- UVXY does not track the S&P 500.

- UVXY does not track the VIX.

- UVXY tracks the daily returns of the one-month blend of first and second month VIX futures.

- These futures are more than 80% of time in contango, resulting in steep losses for UVXY over time.

UVXY History

October 3, 2011, was the first trading day (“inception date”). Note that UVXY started trading as a 2x leveraged ETF tracking the daily returns of the one-month blend of first and second VIX futures.

On February 5, 2018, the infamous Volmageddon event occurred. Quiet equity markets throughout 2017 erupted all of a sudden, and extremely popular short-volatility ETFs such as XIV and SVXY experienced huge losses.

In response to Volmageddon, ProShares lowered UVXY’s leverage factor from 2x to 1.5x effective February 28, 2018.

Given the enormous price declines over time, UVXY must reverse split almost annually to keep its price at a reasonable level for trading. Since 2011, there have been 9 reverse splits, with split ratios from 1:4 through 1:10.

UVXY Trading Strategies

UVXY can be traded long or short. Both approaches can provide outsized returns – with very different risk profiles though!

Long UVXY

Holding a long UVXY position for a longer period will inevitably result in severe losses.

The chart shows back-simulated and leverage-adjusted data (1.5x leverage throughout) for UVXY, starting with the trading of the first VIX futures on March 26, 2004.

The price scale is logarithmic to enable viewing the huge decline of UVXY from around $10 billion in 2004 to $20 in early 2022.

Note that UVXY was not trading at the prices shown here post its inception in 2011 due to its numerous reverse stock splits. Please see above for more on these splits.

Short UVXY

If going long does not work long-term, how about the opposite, how about shorting UVXY for an extended period?

Well, as the above chart shows, there have been huge UVXY spikes. Holding a short position through such a spike would have resulted in catastrophic, possibly irreversible losses.

A few examples:

- During the Global Financial Crisis, UVXY would have gone up around 8.5x within a few weeks in fall 2008.

- In February/March 2020, the novel Coronavirus propelled UVXY 13x up.

- Smaller volatility events, such as the Euro Crisis in 2011 or the Fed Rate Hike Panic at the end of 2018, usually get 2-3x UVXY spikes.

Executional Thoughts

Both long UVXY and short UVXY provide significant risks. The cautious UVXY trader will consider the following:

- Don’t bet the farm. Position sizing is key to avoid outsized losses.

- Set limits. Both long and short positions should be protected by limits to avoid holding a bag of long or short UVXY that is going the wrong way.

- Hedge your exposure. For example, a short UVXY position could be hedged with out-of-the-money UVXY calls. This hedge could protect against an unforeseen major volatility event such as war or a natural disaster.

Similar ETFs and ETNs

Currently, UVXY is the only leveraged ETF or ETN that provides a long exposure to first/second month VIX futures.

VXX and VIXY are unleveraged volatility ETFs or ETNs that track the same underlying.

Opposite/Inverse ETFs and ETNs

SVXY is the only ETF to give a short exposure to first/second month VIX futures. Its leverage factor is 0.5x to protect assets against catastrophic losses in case of a large increase in the underlying in a single day.

Hopefully, this article answered the frequently asked question “How does UVXY work”.

As ProShares, the issuer of UVXY, communicates openly, this ETF is only for knowledgeable investors!

Become a knowledgeable investor and benefit from trading UVXY!