Last update: January 12, 2023

Since the launch of VXX on January 30, 2009 (read more on the history of volatility ETFs and ETNs), quite a number of volatility ETFs and ETNs have followed.

Not all of these newly launched financial products were successful. Some got delisted by their issuers, others blew up spectacularly. But several are now among the most liquid ETFs and ETNs.

Liquid Products

VXX, UVXY and SVXY account for more than 80% of daily trading volume (in $) in volatility ETFs and ETNs.

A long product benefits from VIX futures going up. A short product bets on VIX futures going down or remaining stable at lower levels.

| Ticker | Long/Short | Leverage | Underlying | Options | ETF/ETN | Issuer + Link |

|---|---|---|---|---|---|---|

| VXX | Long | 1x | Daily returns of 30-day blend of VIX futures | liquid | ETN | Barclays iPath |

| UVXY | Long | 1.5x | Daily returns of 30-day blend of VIX futures | very liquid | ETF | ProShares |

| SVXY | Short | 0.5x | Daily returns of 30-day blend of VIX futures | illiquid | ETF | ProShares |

A word of caution on VXX

- Over the last few years, VXX was the clear leader in terms of trading volume and options liquidity.

- However, in March 2022, its issuer stopped creating new shares. This resulted in VXX trading above its fair value. This issue was addressed in September 2022, and since then VXX has been trading normally again. Read our in-depth article.

- Many traders of volatility ETF/ETN options shifted their trading to UVXY options, making these more liquid than VXX options.

Niche Products

| Ticker | Long/Short | Leverage | Underlying | Options | ETF/ETN | Issuer + Link |

| VIXY | Long | 1x | Daily returns of 30-day blend of VIX futures | illiquid | ETF | ProShares |

| UVIX | Long | 2x | Daily returns of 30-day blend of VIX futures | liquid | ETF | VolatilityShares |

| SVIX | Short | 1x | Daily returns of 30-day blend of VIX futures | illiquid | ETF | VolatilityShares |

| VXZ | Long | 1x | Daily returns of blend of 4th-7th month VIX futures | illiquid | ETF | Barclays iPath |

| VIXM | Long | 1x | Daily returns of blend of 4th-7th month VIX futures | illiquid | ETF | ProShares |

Delisted Major VIX / Volatility ETFs and ETNs

The success of the pioneer ETFs and ETNs in the segment of volatility as tracked by VIX futures attracted competitors who often would launch exactly the same product under a different ticker symbol.

Many of these exchange traded products were not successful in generating significant daily trading volume. Consequently, their issuers decided to delist.

A couple of formerly very popular and widely traded ETFs/ETNs deserve mention.

XIV

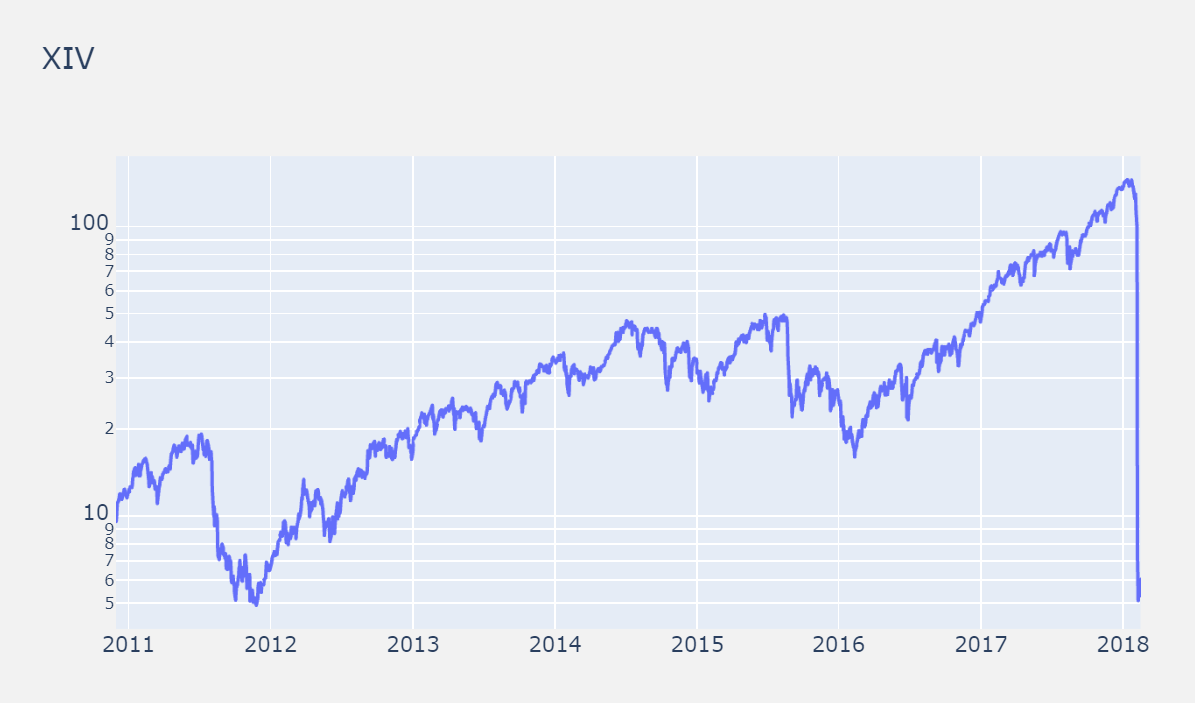

XIV, a short-volatility ETN, started trading on November 30, 2010. It is best-known for its spectacular blow-up on February 5, 2008. This event is remembered as “Volmageddon“.

XIV tracked the short daily returns of the 30-day blend of VIX futures. Unlike today’s SVXY, its leverage factor was 1x, resulting in significant drawdowns during stock market corrections. On the other hand, this leverage factor laid the foundation for XIV’s almost 200% increase in 2017.

The XIV prospectus included the so-called “termination event” clause, giving VelocityShares the right to terminate the fund if its value dropped more than 80% in a single day.

After the termination event on February 5, 2008, Credit Suisse VelocityShares delisted the ETN. February 15 was the last trading day, with XIV closing at $6.04 (96% down from its all-time high of $145.00).

TVIX

TVIX provided long exposure to the daily returns of the 30-day blend of first and second month VIX futures.

The TVIX ETN started trading on November 30, 2010. It became a crowd favorite due to its 2x leverage factor, when UVXY’s leverage factor was decreased from 2x to 1.5x in February 2018.

Unfortunately, its issuer, Credit Suisse VelocityShares, decided to delist this ETN effective July 12, 2020. It continues trading over the counter under the ticker TVIXF but daily volumes have become insignificant.

TVIX, as any other long volatility ETF or ETN, turned out to be an asset-destruction machine. After several reverse stock splits, TVIX had dropped from an (adjusted) opening price of $2.7 billion on November 30, 2010, to a closing price of $123.89 on its last trading day (Friday, July 10, 2020).